|

Senator Obama's Social Security Tax Plan

|

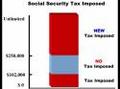

Senator Obama's Social Security Tax Plan

In addition to several other tax increases, Senator Barack Obama wants to increase the Social Security payroll tax burden by imposing the tax on income above $250,000. This would be a sharp departure from current law, which only requires that the tax be imposed on the amount of income needed to "pay for" promised benefits. But more important, at least from an economic perspective, the Senator's initiative would increase the top tax rate on productive behavior by as much as 12 percentage points - and this would be in addition to his proposal to kill the 2003 tax rate reductions and further boost the top rate by 4.6 percentage points. This mini-documentary explains why a big tax rate increase on highly productive people would be very damaging to America's prosperity, especially in a competitive global economy. Simply stated, pushing top tax rates in the United States to French and German levels means at least some degree of French-style and German-style economic stagnation.

Video Length: 14

Date Found: July 23, 2008

Date Produced: July 23, 2008

View Count: 9

|

|

|

|

|

I got punched by an old guy, for farting near his wife. Read MoreComic book creator Stan Lee talks the future of the medium in the digital age. Panelists Zachary... Read MoreThe U.S. launch of Spotify is still on music lovers' minds. Join Zachary Levi, from NBC’s... Read MoreTuesday: Rupert Murdoch testifies before Parliament on the hacking scandal that brought down "News... Read MoreAfter a long slump, the home construction industry may be showing signs of life. But as Bill... Read More | 1 2 3 4 5 |

|

|

|